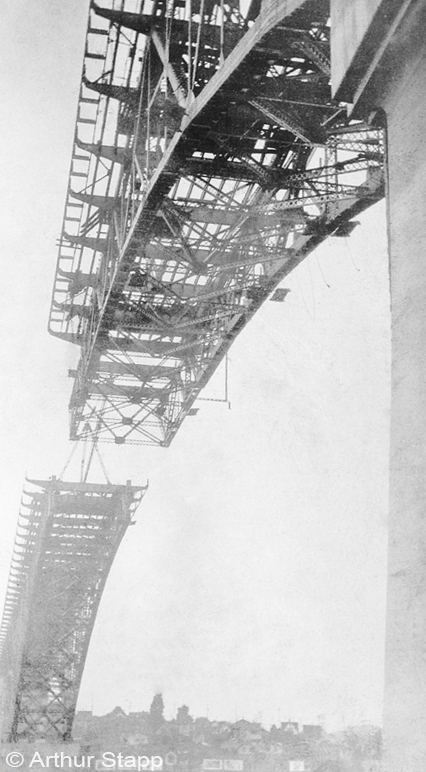

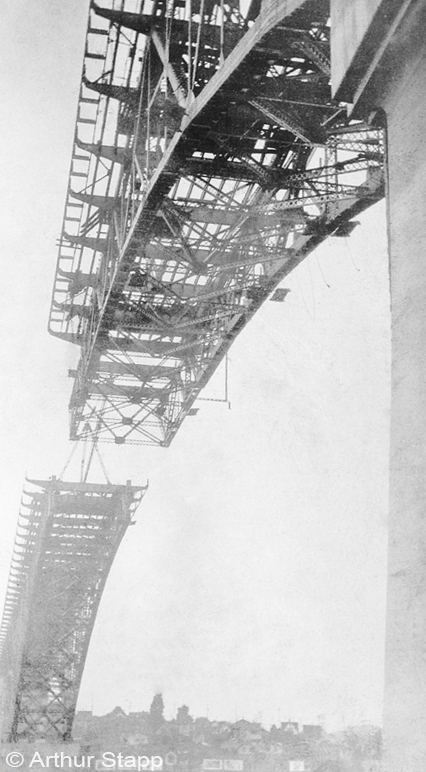

Entitlements Completing the George Washington Memorial Bridge (Aurora Bridge-SR99), Seattle, Washington, 1932 (B&W)This photo of the George Washington Memorial Bridge (Aurora Bridge or SR 99) was taken by my father as it was being completed in 1932, during the period of the Great Depression. It was converted to black and white. Connecting Seattle’s Queen Anne Hill to Fremont, spanning over the Lake Washington Ship Canal, the Bridge’s construction was an engineering accomplishment in the midst of hard times. A bridge spans an obstacle to bring two areas together, to allow passage. It may be used symbolically in others areas such as a music bridge, an interlude that connects two parts of a song, or a bridge loan (interim financing).For me, it also symbolizes bridging the gap between work and retirement. In these days before the August 2, 2011 deadline to raise the national debt limit, it also symbolizes the need to bridge the gap between parties, to compromise on a solution to our national debt problem. Should that attempt fail, it will symbolize solutions to solve the financial gap.As we march towards a potential default of the national debt, a large part of the debate centers around the impact that entitlements have on our nation’s expenditures. Entitlements consist of Social Security, Medicare and Medicaid. Entitlements have grown to comprise a large portion of our nation’s expenditures and contributions to our nation’s burgeoning national debt. Social Security comprised 20% of the nation’s 2010 fiscal year budget while Medicaid and Medicare together comprised 23% (Wikipedia). Together, the three programs comprised 43% of the nation’s 2010 fiscal budget. Moreover, the cost of these three programs are expected to grow over the coming years. With such a considerable portion of our nation’s budget tied up in entitlement programs, it is difficult to find areas to cut. If you leave entitlements alone, you are left with 57% of the budget. If military expenses (20%) are left untouched, only 37% of the budget is left to work with.Historically, the concept of cutting Social Security has been likened politically to touching the electrified “third rail”. Social Security, Medicare and Medicaid have a storied history and a large degree of public need and acceptance (and entitlement) that makes them difficult to reduce.There has been a greater willingness to tackle the issue of entitlement programs in the recent national debt talks; however such endeavors may leave a sense of disconnect with the public who may be unaware of the cuts should they actually occur.There are many factors reflected in the increases in entitlement costs (and their projected costs into future years). One common factor is demographics.Demographics

Completing the George Washington Memorial Bridge (Aurora Bridge-SR99), Seattle, Washington, 1932 (B&W)This photo of the George Washington Memorial Bridge (Aurora Bridge or SR 99) was taken by my father as it was being completed in 1932, during the period of the Great Depression. It was converted to black and white. Connecting Seattle’s Queen Anne Hill to Fremont, spanning over the Lake Washington Ship Canal, the Bridge’s construction was an engineering accomplishment in the midst of hard times. A bridge spans an obstacle to bring two areas together, to allow passage. It may be used symbolically in others areas such as a music bridge, an interlude that connects two parts of a song, or a bridge loan (interim financing).For me, it also symbolizes bridging the gap between work and retirement. In these days before the August 2, 2011 deadline to raise the national debt limit, it also symbolizes the need to bridge the gap between parties, to compromise on a solution to our national debt problem. Should that attempt fail, it will symbolize solutions to solve the financial gap.As we march towards a potential default of the national debt, a large part of the debate centers around the impact that entitlements have on our nation’s expenditures. Entitlements consist of Social Security, Medicare and Medicaid. Entitlements have grown to comprise a large portion of our nation’s expenditures and contributions to our nation’s burgeoning national debt. Social Security comprised 20% of the nation’s 2010 fiscal year budget while Medicaid and Medicare together comprised 23% (Wikipedia). Together, the three programs comprised 43% of the nation’s 2010 fiscal budget. Moreover, the cost of these three programs are expected to grow over the coming years. With such a considerable portion of our nation’s budget tied up in entitlement programs, it is difficult to find areas to cut. If you leave entitlements alone, you are left with 57% of the budget. If military expenses (20%) are left untouched, only 37% of the budget is left to work with.Historically, the concept of cutting Social Security has been likened politically to touching the electrified “third rail”. Social Security, Medicare and Medicaid have a storied history and a large degree of public need and acceptance (and entitlement) that makes them difficult to reduce.There has been a greater willingness to tackle the issue of entitlement programs in the recent national debt talks; however such endeavors may leave a sense of disconnect with the public who may be unaware of the cuts should they actually occur.There are many factors reflected in the increases in entitlement costs (and their projected costs into future years). One common factor is demographics.Demographics

Baby boomer demographics is a major reason for the increase in entitlement costs now and into the future. Baby boomers are considered to be those individuals born between 1946 and 1964, following World War II. There was a peak in births during that time period that has resulted in increased proportions of individuals for that cohort as the cohort has progressively moved down the arrow of time from birth to retirement. Consider a snake that has swallowed a mouse for dinner; you can see the progress in the snake’s digestion of the mouse as the mouse’s shape progresses down the long sleek lines of the snake’s body. In a demographic diagram, the baby boomer population exhibits somewhat similar characteristics, impacting each age group disproportionately as it ages.Thus, the increased birth rate during the baby boomer years results in increased expenses as baby boomers age. These increased older populations will stress entitlement programs, with fewer younger workers to provide the population base to pay for benefits for the older population.The ChallengeThe projected growth in entitlement spending represents a real challenge, and must be faced by creative solutions that address the problem for not just the immediate future, but for the long term. Such solutions must address needed social needs while at the same time managing costs.

Mt St Helens crater and Toutle River, Cascade Range, Washington, 2011 (image on Photoshelter)Discussions between Congress and the White House regarding raising the National Debt Limit are an example of the considerable political risks in our current system. My concern is that failure to agree on a solution to raise the debt limit may cascade into financial disaster. It is a balance-of-risks issue that our leaders will ultimately be judged on.Political risk issues include:

Mt St Helens crater and Toutle River, Cascade Range, Washington, 2011 (image on Photoshelter)Discussions between Congress and the White House regarding raising the National Debt Limit are an example of the considerable political risks in our current system. My concern is that failure to agree on a solution to raise the debt limit may cascade into financial disaster. It is a balance-of-risks issue that our leaders will ultimately be judged on.Political risk issues include:- The polarization of political parties such that the more extreme elements dominate each party, and become nominated for office, crowding out the moderates.

- The emergence of non-elected individuals ‘asking’ that candidates sign ‘pledges’ which politically tie candidates to certain positions, limiting their flexibility to act.

- The inability of politicians to act in the interest of the nation.

Politicians need to be able to consider the best interest of the nation as a whole. Their inability to do so jeopardizes our nation. The clear and present danger is that the United States will default on its debt on August 3, 2011 if the national debt limit is not raised by that time.Should the United States default on its debt, there would be serious ramifications. Ratings agencies have already given warnings regarding our debt rating. In this July 14, 2011 Bloomberg story, Moody’s placed the United States’s Credit rating under review for a downgrade. In this July 16, 2011 LA Times article, Standard and Poor’s has also warned that they may cut the United States’s top AAA debt rating as a result of the lack of an agreement to raise the debt limit. In an article in Reuters 7/18/2011, Moody’s stated that the United States should “eliminate its statutory limit on government debt to reduce uncertainty among bond holders”. A decrease in the United States’s ratings by rating agencies would likely result in an increase in the interest rate that our country pays on our debt. This would increase the cost of financing the United States debt and also have reverberations throughout the marketplace, driving up interest rates generally. Failure to raise the debt limit could conceivably cascade into a financial catastrophe.The seriousness of what could be a cascading financial disaster is brought home by an article in the Insurance Journal: S&P Threatens Downgrade of Insurers, Financial Firms Over Debt Ceiling” indicating that S&P could downgrade a number of financial institutions should the government fail to act to raise the debt limit.Currently, Treasuries are regarded as “risk-free” currencies. Should our Government’s rating be downgraded they and other government securities may well be assessed higher capital charges in regulatory and rating agency models. The securities would included various securities including Fannie Mae and Freddie Mac, the latter two key to the mortgage market. Increased capital charges may potentially result in financial institutions being downgraded by rating agencies. If a financial institution is so downgraded as a result of the government failing to act on the national debt, it could trigger other events. “Ratings triggers” in the financial institution’s policies could be triggered, allowing a large withdrawal of policyholder funds from large investors, perhaps at book value,An increase in the interest rate would have impact in the marketplace, in valuation of assets, in home and auto loans and refinancings. It would alter institutional and personal behavior. Depending on the size of the interest rate increase, an increase in rate could impact stable value funds that promise payout at book value. Importantly, it would cost more to finance the United States debt with a higher interest rate.Treasuries have been long regarded as ‘safe’ and it is be “interesting” to speculate how changes in their quality rating would reverberate throughout the financial marketplace in the event the U.S. government fails to raise the debt limit by August 3, 2011.President Obama does not want to “kick the can down the road” instead preferring a longer term solution to the problem that includes spending cuts and revenue increases. The Republicans do not want to consider revenue increases. Some have signed a pledge not to increase taxes and are constrained by that.The danger is that the United States will default on its debt on August 3, 2011 if it does not raise the debt limit. We have an examples in history where one small thing cascaded into a major calamity. One event that comes to mind is the Great Seattle Fire of 1889 where glue boiling over into a gasoline fire ignited wood chips and eventually burned down 32 blocks of Seattle, including business district, wharves and railroad terminals.Do we want our government leaders shackled by the bounds of rigid ideology, watching the debt limit “glue pot” boil over into the “incendiary” market of interest and credit risk, cascading into a market conflagration that “burns” many in our economy? I would hope our leaders get wise and come to an agreement that will avert disaster in our financial markets. Maybe I am wrong. Maybe these risks won’t materialize or will do so to a minor extent. However it is uncharted waters and do you want to bet the farm that the serious risk will not materialize? President Obama needs to consider a short term deal that gets us over this deadline. The Republicans need to consider raising taxes, even if it means violating a pledge not to raise taxes.In 2012 the voters will hold our leaders accountable if they watched the pot boil over into the flames and cascade into disaster when they could have come to agreement.It is an issue of balance-of-risks. The risks of watching the debt pot boil over and cascade into a financial conflagration over over some ideological shackles are just not worth it.

Nuclear reactor technology has allowed the world-wide use of nuclear reactors for energy production. With the world faced with mounting carbon dioxide levels and global warming a concern, nuclear energy provides a low carbon emission alternative to traditional energy sources (World Nuclear Association and MIT study). This aspect of nuclear energy makes it a very attractive energy alternative. With President Obama wishing to expand the United States nuclear power plant program, the question becomes an issue of balance-of-risks.Accelerating nuclear reactor development provides a low carbon emission energy source; however there is risk associated with the use of nuclear materials. If we do not take advantage of nuclear’s low carbon footprint and instead pursue other, higher carbon footprint strategies, we risk exacerbating global warming issues. There are other options, as well, such as cleaner technologies, emerging energy technologies and reducing fertility rates to decrease population size.We seek to understand the low probability, high impact, long-tail risks associated with the use of nuclear materials. Since the dawning of the nuclear age, mankind has worked to harness the power of the atom. There have been many benefits from the use of radionuclides. However, there are risks as well.Risk areas to consider in looking at nuclear energy include:- Economic, including Externalities

- Design and Construction

- Natural Disasters

- Operations and Management

- Political and Regulatory

- Terrorism, War and Sabotage

- Radioactive Waste Treatment and Storage

We have had experience with nuclear accidents that display some of that high impact, long-tail risk. Previous blog articles have discussed Chernobyl, Three Mile Island and Fukushima (3/12/11, 3/25/11 and 3/28/11).We have seen historical flooding on the Missouri River which threatened Fort Calhoun Nuclear Plant and Cooper Nuclear Plant in Nebraska. Recently we have seen the large Las Conchas Wildfire threaten the Los Alamos Energy Department facility in New Mexico. These situations, including those situations where facilities were threatened but not breached, are all reminders that radiation is a serious risk and not simply an abstract probability.

Externalities Refinery Exhaust Stacks, Anacortes, Washington (image on Photoshelter)Air pollution from a fixed stack is a good example that can be used to explain the concept of an externality. I discussed the externalities previously in a blog article (Risk and Externalities) in the context of the BP oil spill and its widespread impact in the Gulf of Mexico. On the production side, externalities come into play when the full cost of production is not reflected in the cost of the good.Air pollution emissions may contain various pollutants, gaseous and particulate matter. The area impacted and the degree of impact will be affected by the pollutants released and the meteorological conditions.For example, a temperature inversion will keep cold air close to the surface under a layer of warm air so that the air does not mix well vertically. The pollutants will be kept closer to the surface and their impact will be greater.Sulfur dioxide emissions may impact lakes and fish (as acid rain), and thus ecosystems. Sulfur dioxide is a harmful pollutant for humans as well as fish. Sulfur dioxide can adhere to airborne suspended particulate matter. If the particulate matter is small, this may ease entry into the lung where the sulfur dioxide can do greater harm. Air pollution is a direct result of the manufacturing process that extends from the stack into the community and beyond. It’s impact results in costs to others. Thus there are costs associated with air pollution that are not included in the production costs. To the extent that this is true, the product produced is under priced, and the public, an external entity, is paying those additional costs.Costs include medical costs, as well as reduced life expectancy due to the pollution. Air pollution, in addition to being unhealthy, reduces visibility, may add odor, and adds quality of life issues. Pollution impacts maintenance of buildings and other structures.Determing costs attributable to air pollution is a complex problem. There have been studies done to ascertain such costs. For example, a RAND study looked at health costs in California attributable to air pollution above state standards. That study would reflect air pollution due to a variety of causes, not just the point sources discussed in this blog article. California has a great deal of automobile pollution which contributes to carbon monoxide and ozone pollution problems. Monitoring and regulation of air pollutants requires resources as well. Air pollution regulation and monitoring exists at the federal, state and local levels. To reiterate, the producer’s price does not reflect these costs. Thus the price of the good is under priced with respect to other options because it does not include the cost of these “external” costs which others must bear. When full external costs are brought into the mix, the producer’s price must necessarily increase. As it increases, other competing options may become more attractive and the producer may lose business. Alternatively, the producer may choose to upgrade the method of production to reduce the pollution, a cost they may not be willing to take if full external costs were included.Air pollution is one example of an externality. The situation becomes more complicated where the risk matrix considers low probability, high risk events. Such events may be difficult to estimate and to price for. Even assuming these low probability, high risk events could be reasonably priced for, it may be impossible for the producer to compete with prices reflecting such a risk margin. Competitors in the same field may refuse to include such a risk margin, thus driving the producer out of business. Competitors in other fields without such a risk margin will be at an advantage.Where the risk margin for the low probability, high impact event is not priced for and is not included in the pricing there is the potential for considerable externality impacts should the low probability high impact risk event materialize. As previous nuclear disasters have shown, the low probability, high risk event presents considerable externality issues in the nuclear arena, considering the serious impacts of radiation. (See my blog articles, Chernobyl 25th Anniversary and Energy Choices and Risk).

Refinery Exhaust Stacks, Anacortes, Washington (image on Photoshelter)Air pollution from a fixed stack is a good example that can be used to explain the concept of an externality. I discussed the externalities previously in a blog article (Risk and Externalities) in the context of the BP oil spill and its widespread impact in the Gulf of Mexico. On the production side, externalities come into play when the full cost of production is not reflected in the cost of the good.Air pollution emissions may contain various pollutants, gaseous and particulate matter. The area impacted and the degree of impact will be affected by the pollutants released and the meteorological conditions.For example, a temperature inversion will keep cold air close to the surface under a layer of warm air so that the air does not mix well vertically. The pollutants will be kept closer to the surface and their impact will be greater.Sulfur dioxide emissions may impact lakes and fish (as acid rain), and thus ecosystems. Sulfur dioxide is a harmful pollutant for humans as well as fish. Sulfur dioxide can adhere to airborne suspended particulate matter. If the particulate matter is small, this may ease entry into the lung where the sulfur dioxide can do greater harm. Air pollution is a direct result of the manufacturing process that extends from the stack into the community and beyond. It’s impact results in costs to others. Thus there are costs associated with air pollution that are not included in the production costs. To the extent that this is true, the product produced is under priced, and the public, an external entity, is paying those additional costs.Costs include medical costs, as well as reduced life expectancy due to the pollution. Air pollution, in addition to being unhealthy, reduces visibility, may add odor, and adds quality of life issues. Pollution impacts maintenance of buildings and other structures.Determing costs attributable to air pollution is a complex problem. There have been studies done to ascertain such costs. For example, a RAND study looked at health costs in California attributable to air pollution above state standards. That study would reflect air pollution due to a variety of causes, not just the point sources discussed in this blog article. California has a great deal of automobile pollution which contributes to carbon monoxide and ozone pollution problems. Monitoring and regulation of air pollutants requires resources as well. Air pollution regulation and monitoring exists at the federal, state and local levels. To reiterate, the producer’s price does not reflect these costs. Thus the price of the good is under priced with respect to other options because it does not include the cost of these “external” costs which others must bear. When full external costs are brought into the mix, the producer’s price must necessarily increase. As it increases, other competing options may become more attractive and the producer may lose business. Alternatively, the producer may choose to upgrade the method of production to reduce the pollution, a cost they may not be willing to take if full external costs were included.Air pollution is one example of an externality. The situation becomes more complicated where the risk matrix considers low probability, high risk events. Such events may be difficult to estimate and to price for. Even assuming these low probability, high risk events could be reasonably priced for, it may be impossible for the producer to compete with prices reflecting such a risk margin. Competitors in the same field may refuse to include such a risk margin, thus driving the producer out of business. Competitors in other fields without such a risk margin will be at an advantage.Where the risk margin for the low probability, high impact event is not priced for and is not included in the pricing there is the potential for considerable externality impacts should the low probability high impact risk event materialize. As previous nuclear disasters have shown, the low probability, high risk event presents considerable externality issues in the nuclear arena, considering the serious impacts of radiation. (See my blog articles, Chernobyl 25th Anniversary and Energy Choices and Risk).