Entitlements

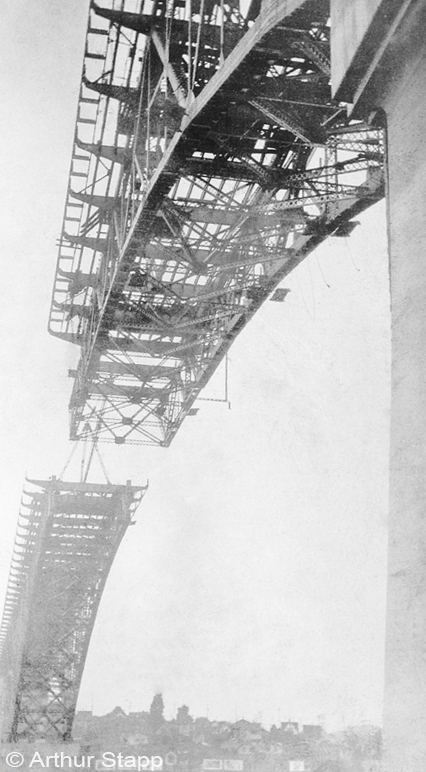

Completing the George Washington Memorial Bridge (Aurora Bridge-SR99), Seattle, Washington, 1932 (B&W)

This photo of the George Washington Memorial Bridge (Aurora Bridge or SR 99) was taken by my father as it was being completed in 1932, during the period of the Great Depression. It was converted to black and white. Connecting Seattle’s Queen Anne Hill to Fremont, spanning over the Lake Washington Ship Canal, the Bridge’s construction was an engineering accomplishment in the midst of hard times.

A bridge spans an obstacle to bring two areas together, to allow passage. It may be used symbolically in others areas such as a music bridge, an interlude that connects two parts of a song, or a bridge loan (interim financing).

For me, it also symbolizes bridging the gap between work and retirement.

In these days before the August 2, 2011 deadline to raise the national debt limit, it also symbolizes the need to bridge the gap between parties, to compromise on a solution to our national debt problem. Should that attempt fail, it will symbolize solutions to solve the financial gap.

As we march towards a potential default of the national debt, a large part of the debate centers around the impact that entitlements have on our nation’s expenditures. Entitlements consist of Social Security, Medicare and Medicaid. Entitlements have grown to comprise a large portion of our nation’s expenditures and contributions to our nation’s burgeoning national debt.

Social Security comprised 20% of the nation’s 2010 fiscal year budget while Medicaid and Medicare together comprised 23% (Wikipedia). Together, the three programs comprised 43% of the nation’s 2010 fiscal budget. Moreover, the cost of these three programs are expected to grow over the coming years.

With such a considerable portion of our nation’s budget tied up in entitlement programs, it is difficult to find areas to cut. If you leave entitlements alone, you are left with 57% of the budget. If military expenses (20%) are left untouched, only 37% of the budget is left to work with.

Historically, the concept of cutting Social Security has been likened politically to touching the electrified “third rail”. Social Security, Medicare and Medicaid have a storied history and a large degree of public need and acceptance (and entitlement) that makes them difficult to reduce.

There has been a greater willingness to tackle the issue of entitlement programs in the recent national debt talks; however such endeavors may leave a sense of disconnect with the public who may be unaware of the cuts should they actually occur.

There are many factors reflected in the increases in entitlement costs (and their projected costs into future years). One common factor is demographics.

Demographics

Completing the George Washington Memorial Bridge (Aurora Bridge-SR99), Seattle, Washington, 1932 (B&W)

This photo of the George Washington Memorial Bridge (Aurora Bridge or SR 99) was taken by my father as it was being completed in 1932, during the period of the Great Depression. It was converted to black and white. Connecting Seattle’s Queen Anne Hill to Fremont, spanning over the Lake Washington Ship Canal, the Bridge’s construction was an engineering accomplishment in the midst of hard times.

A bridge spans an obstacle to bring two areas together, to allow passage. It may be used symbolically in others areas such as a music bridge, an interlude that connects two parts of a song, or a bridge loan (interim financing).

For me, it also symbolizes bridging the gap between work and retirement.

In these days before the August 2, 2011 deadline to raise the national debt limit, it also symbolizes the need to bridge the gap between parties, to compromise on a solution to our national debt problem. Should that attempt fail, it will symbolize solutions to solve the financial gap.

As we march towards a potential default of the national debt, a large part of the debate centers around the impact that entitlements have on our nation’s expenditures. Entitlements consist of Social Security, Medicare and Medicaid. Entitlements have grown to comprise a large portion of our nation’s expenditures and contributions to our nation’s burgeoning national debt.

Social Security comprised 20% of the nation’s 2010 fiscal year budget while Medicaid and Medicare together comprised 23% (Wikipedia). Together, the three programs comprised 43% of the nation’s 2010 fiscal budget. Moreover, the cost of these three programs are expected to grow over the coming years.

With such a considerable portion of our nation’s budget tied up in entitlement programs, it is difficult to find areas to cut. If you leave entitlements alone, you are left with 57% of the budget. If military expenses (20%) are left untouched, only 37% of the budget is left to work with.

Historically, the concept of cutting Social Security has been likened politically to touching the electrified “third rail”. Social Security, Medicare and Medicaid have a storied history and a large degree of public need and acceptance (and entitlement) that makes them difficult to reduce.

There has been a greater willingness to tackle the issue of entitlement programs in the recent national debt talks; however such endeavors may leave a sense of disconnect with the public who may be unaware of the cuts should they actually occur.

There are many factors reflected in the increases in entitlement costs (and their projected costs into future years). One common factor is demographics.

Demographics

Baby boomer demographics is a major reason for the increase in entitlement costs now and into the future. Baby boomers are considered to be those individuals born between 1946 and 1964, following World War II. There was a peak in births during that time period that has resulted in increased proportions of individuals for that cohort as the cohort has progressively moved down the arrow of time from birth to retirement.

Consider a snake that has swallowed a mouse for dinner; you can see the progress in the snake’s digestion of the mouse as the mouse’s shape progresses down the long sleek lines of the snake’s body. In a demographic diagram, the baby boomer population exhibits somewhat similar characteristics, impacting each age group disproportionately as it ages.

Thus, the increased birth rate during the baby boomer years results in increased expenses as baby boomers age. These increased older populations will stress entitlement programs, with fewer younger workers to provide the population base to pay for benefits for the older population.

The Challenge

The projected growth in entitlement spending represents a real challenge, and must be faced by creative solutions that address the problem for not just the immediate future, but for the long term. Such solutions must address needed social needs while at the same time managing costs.